Effect Of Covid-19 On Sea Freight

EFFECT OF COVID-19 ON SEA FREIGHT

HD-Chang Industry Co., Limited

7 July 2021

INTRODUCTION

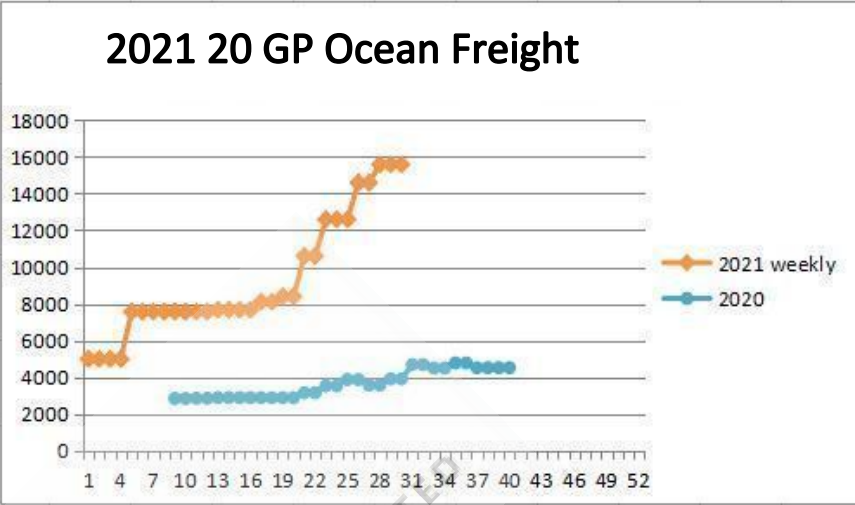

Sea freight routes from China to the West have been hit with a steady stream of disruptions since the start of 2020. A perfect storm of reduced sailings, booming demand, trade imbalance, reduced workforces, ship delays and port congestion has adversely affected trade all trade routes from Asia to the West. Forward rate contracts became useless, as spot prices were increasing 20% weekly and surcharges to secure containers skyrocketed.

Above: Ocean Freight rates, including all surcharges (PSS, GRI, etc.,) from Shanghai to Europe. Source: Kerry Logistics

BACKGROUND

THE FIRST 6 MONTHS

Early 2020 in China when the virus first emerged, it resulted in the immediate countrywide closure of factories. At the time, the virus was viewed as a “China problem”, so global demand for products from China continued. When the virus spread to Europe and North America in the spring, companies immediately halted production orders and cargo demand from East to West dropped suddenly and significantly.

Freight carriers reacted to the massive decline in demand by suspending entire trade loops and cancelling suddenly a massive number of sailings. This reaction stabilized spot prices in the short term but also lead to a sudden, huge inventory of goods waiting to be shipped. Air cargo shipments also piled up as commercial flights were virtually eliminated, requiring all that cargo to now be transferred to sea shipments.

Q2 AND Q3 OF 2020

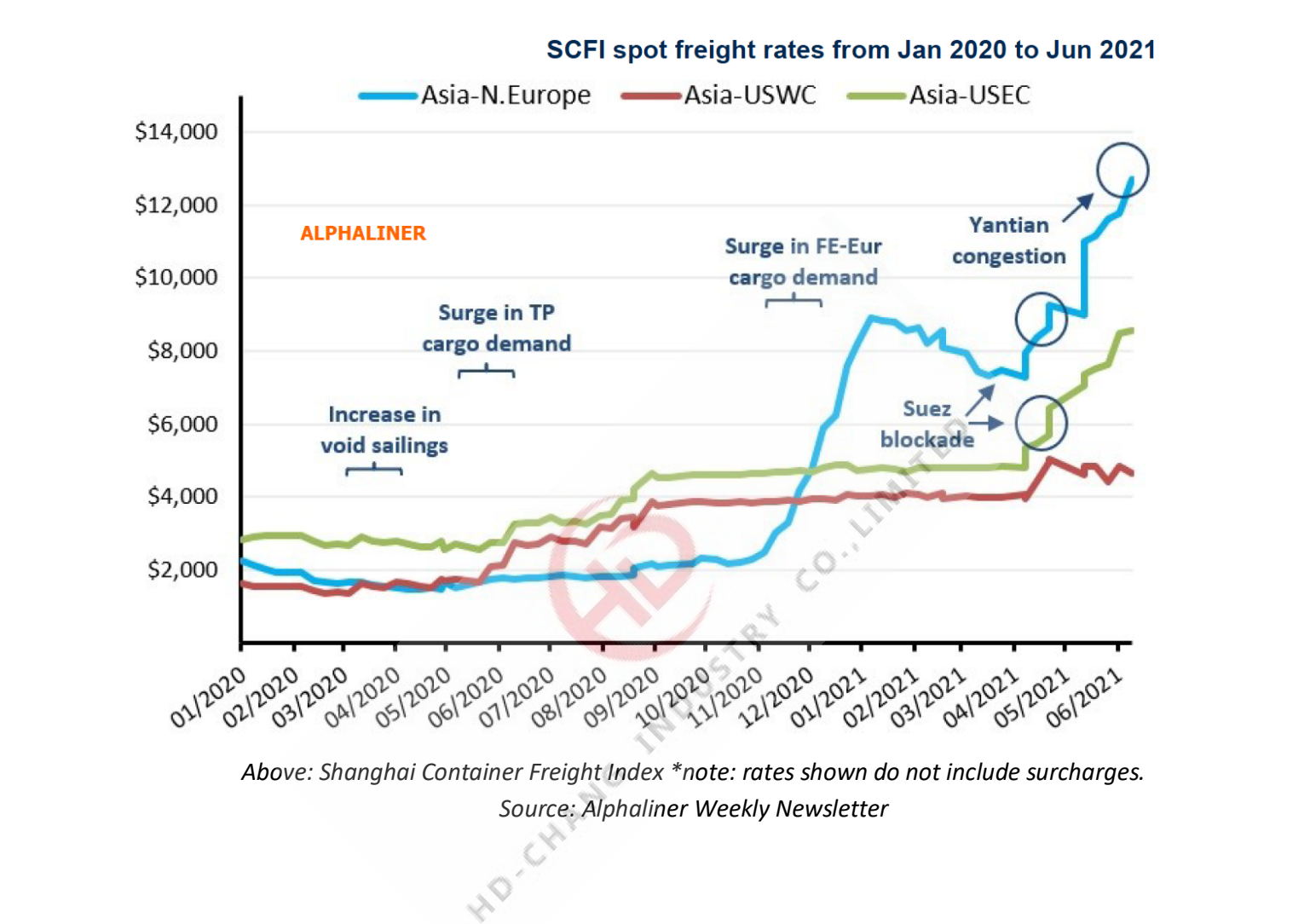

In the Summer and Fall of 2020, huge consumer demand, attributed to a boom of e-commerce shopping, resulted in a massivesurge of demand for cargo space from China to the West. Ports globally however, were operating at reduced capacity due to COVID-19 workplace restrictions. This lower capacity at the ports led to port congestion as ships waited to be loaded and offloaded, and tied-up the already tight number of available boats. It was at this time spot prices for freight began to climb.

Another consequence of the surge in demand from the West was the imbalance of trade, resulting in far more containers flowing from East to West, but not returning. It is estimated that for every 4 containers shipping East to West, only 1 returns. This resulted in a shortage of available shipping containers, putting even further pressure on prices as exporters fought to secure containers and for space on the container ships. Freight Rates and the surcharges (PSS, GRI, etc.) to secure containers reached unprecedented levels.

Q1 2021

Rates in Q1 of 2020 appeared to stabilize, albeit at elevated rates. In November of 2021 Corozo began securing freight rate contracts for our export clients. The blockage in the Suez Canal at the end of March created renewed disruption to schedules, causing rates to begin the climb again.

CURRENT SITUATION

The latest chapter in this saga is the current COVID-19 outbreak of the Delta variant in Guangzhou and at the port of Yantian. Yantian Port is the largest Sea Freight port in China but is currently operating at only about 40% capacity, leading to further congestion. Due to the port’s size, it is expected that the reduced capacity will have an even larger disruptive effect than the blockage in the Suez Canal. The congestion in the south of China is naturally spilling over to the ports in China. The effect on prices has been profound, with some clients in Europe resorting to trucking their goods from China to Europe.

The current freight environment is one with a tight supply of ships, tight supply of containers, port congestion and a limited alternative route options for shippers. Spot freight rates on China – Americas West Coast routes from January 2020 to June 2021 are up over 400%. Although there are mitigating factors in the works (described below) that will create downward pricingpressure, it is unlikely that there will be any relief for shippers during the remainder of 2021.

LOOKING FORWARD

There are reasons to expect recovery in freight rates, however some of the things that will bring relief are slow to come online,while others are dependent of the virus and vaccine situation globally. Some positive factors that will help with bringing rates back down are as follows;

• More containers: China is currently producing 5000 new containers per month, but demand and existing cargoinventory levels are keeping container availability low. As Peak season ends and inventory levels decrease,there will be reduced demand on container space

• More Boats: Freight lines are building more boats, scheduled to start sailing in Q2 2022. With the resumption of older trade loops this will add capacity to the global freight network

• Inventory replenishments after Peak Season – Retailers have been ordering elevated levels of inventory since Q2 2020, which was one of the contributing factors to the problem. Working through the delays, this inventory in onhand now and in time for the opening-up of economies currently in full swing in the West.

• Vaccine Rollouts

o as vaccines roll-out and people’s lives return to a pre-pandemic normal, economies are expected to rebalance from a product-centric to service-centric, thereby reducing demand for Chinese goods and reducing the risk of new surges in consumer demand.

o Though not widely reported, there have been sporadic outbreaks of the virus in China throughout thepandemic. China’s reaction to outbreaks is swift and strict, but effective. The Yantian port disruption maybe resolved faster than expected. For reference, the Suez Canal blockage only lasted 6.5 days, so a speedy recovery of port operations will have a very positive impact.

o Resumption of commercial flights – It is expected that border restrictions in China will begin to ease in early 2022 as vaccines reach 70% of the population. This will make cargo space on commercial flights available again and permit the travel of business visitors, further reducing demand on sea freight.

• China central government influence – The CCP is keenly aware of the situation as China’s GDP is still heavily dependent on exports. A national council has been created to try and find ways to alleviate the issue. Although the government cannot directly control sea freight rates, they could, for example, offer tax breaks to exporters, make investments into container capacity, or employ other techniques to reduce the financial burden on exporters.